It is uncommon even if, while the Rounding Best Development favors bearish effects. Certainly one of the chief pros is actually the large probability of achievements, therefore it is probably one of the most successful chart patterns to own development continuation. The new trend brings really-discussed admission and prevent-losings profile, making it possible for investors to manage exposure effectively. The fresh pattern is used in the fast-swinging locations due to its ability to indicate good directional momentum. The brand new flagpole represents the original sharp flow, plus the flag is short for the new thin variety where price consolidates. It is an optimistic chart pattern otherwise a bearish graph pattern depending on the before development.

Preferred Problems to stop When using Trading Models in the 2025

Bullish graph designs and you may bearish graph patterns mode according to the trend’s guidance. Investors need to watch for not the case breakouts, and https://immediate-meta.com/ this are present whenever rates briefly motions outside the trend prior to treating. Flag and you may Pennant Models are successful chart models whenever traded precisely.

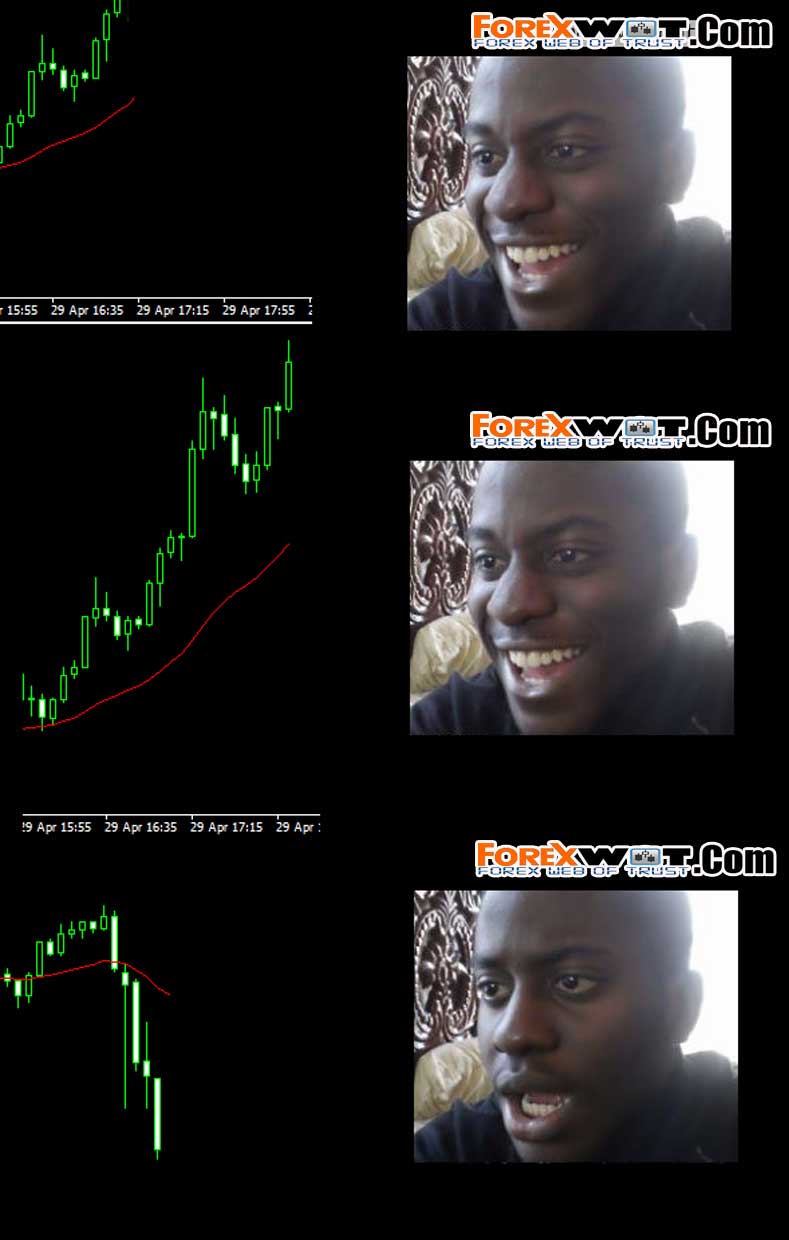

This type of charts help in distinguishing style and you will business sentiment, having sequences from eco-friendly candlesticks demonstrating up style and you can reddish candlesticks appearing down fashion. The brand new dragonfly doji trend is created if the business feel an excellent good bearish energy followed closely by a sudden getting rejected of your own all the way down rates. That it pattern signals a potential move within the market sentiment out of bearish in order to bullish. The brand new gravestone doji development is made when the market feel a good solid bullish energy with an unexpected getting rejected of your high rates.

The quantity will slip while the trend models and you can rebound because the rates getaways out of the neckline. Reverse habits imply a move in the business sentiment on the newest development. This type of designs imply the brand new prominent participants, bulls or holds, have lack steam. Yet not, the cost you may sometimes bust out of one’s resistance peak, signalling a prospective reversal to the upside.

Ideas on how to Change Ascending Increasing Wedge?

The brand new Bullish Rectangle is actually an extension trend that happens throughout the a keen uptrend, proving a short-term stop until the rates will continue to rise. They features a couple synchronous lateral outlines, to your speed oscillating between a resistance line at the top and an assistance range in the bottom. It trend stands for a balance anywhere between customers and you can sellers, but the breakout always occurs on the upside, resuming the original uptrend. Price ActionThe Flag pattern implies that after a-sharp rates move, industry takes a fleeting pause. Customers and sellers try temporarily under control, on the price moving in a thin diversity. Although not, the newest pattern is still dominating, as well as the breakout regarding the flag indicators the past development is beginning right up once again, when it’s optimistic or bearish.

Is Candlestick Habits Credible?

By leveraging these power tools and you will tips, I’ve significantly increased my personal time trading capabilities. They’ve made me identify patterns far more correctly, perform risk effortlessly, to make much more informed trading conclusion. By simply following these types of procedures, We changes my day change habits cheat piece away from a straightforward source guide to your a powerful decision-and then make equipment, boosting my personal trading overall performance and you can possibility success. As the twenty four hours investor, I’ve found that acknowledging patterns is crucial to achieve your goals on the fast-paced arena of intraday trading. Typically, I’ve install a chance-to cheating layer of reliable designs that have consistently helped me generate informed conclusion and you may maximize earnings.

Momentum-Based Habits

- As well, they might represent a bounce development once a robust uptrend, otherwise an extension pattern while in the a downtrend.

- It’s discussed because of the a horizontal help range towards the bottom, in which the rate repeatedly bounces but does not break lower, and a low-sloping trendline on the top, where the rates versions all the way down highs.

- Buyers admit these structures around the numerous timeframes from one-moment charts to monthly opinions.

- The new designs are used inside popular places and are modified to help you additional timeframes.

Reversals you to definitely are present at the business tops have been called shipping patterns, in which the trade device gets to be more eagerly marketed than just purchased. In contrast, reversals you to exist during the market bottoms are called buildup designs, in which the exchange instrument becomes more definitely ordered than just offered. The cost of ABC Corp. denied of $70 to $50, developing the brand new rounding base. The purchase price up coming moved laterally between $50 and you can $55 for a time before starting the increase on the $70.The newest resistance try molded during the $55. Available look analysis signifies that most time buyers aren’t successful.

When you’re models will be powerful devices within the trade, you do need to comprehend the limits. A lot more levels of analysis offer confirmation and you may enhance your trade configurations. When you are designs like the Head and you may Arms perform provide counted flow plans, you should look at the larger framework of your own trend. Flags can also be persist for several days or even months, thus entering at the diversity reduced allows for a wide prevent losses. The newest Glass and you will Manage trend is a kind of rounded base development, even when its shape and size may differ. At the conclusion of the afternoon, they’re an artwork help observe alterations in field requirements more with ease.

- The newest temporary rally are accompanied by a sharp refuse, guaranteeing the newest continuation of your own earlier trend.

- During the business peaks, reversals are called distribution patterns, where the economic asset has much more offering stress than to find stress.

- They goes on in the same guidance because the flagpole, because the speed getaways outside of the consolidation zone.

- Bullish chart models exist if speed holiday breaks above the top opposition number of the brand new rectangle, signaling an extension of one’s earlier uptrend.

By understanding such patterns and to avoid popular pitfalls you’ll be better supplied and make advised conclusion. Usually prioritize risk administration and use the equipment and tips available to improve your talent. Which have effort and the best means you can change trend recognition for the a secured asset on your own trade journey. I always look at the broader field framework, in addition to development advice, support and opposition membership, and you may full industry sentiment. Go out trading is actually a leading-strength money approach where buyers buy and sell financial devices within this a single trade go out. We do deals according to small-name speed motions, aiming to profit from brief industry motion.

Trading and investing Habits: Popular Models and methods to possess Professional Investors

The newest chart helps buyers choose opportunities to enter deals in line for the principal trend. The 3 Drives development are an incredibly predictive reverse graph development utilized in the forex market. It is described as an accurate flow away from about three consecutive and you may symmetric movements (otherwise “drives”) within the a certain advice, for each and every followed closely by a moderate retracement. Inside an optimistic pattern, the fresh trend screens about three straight large levels, whereas in the a great bearish trend, they reveals about three successive straight down lows.

The price varies between the top resistance and lower help lines, allowing investors to enter enough time ranks near help and you will log off near resistance. A breakdown underneath the straight down trend line suggests a pattern reversal, transitioning it to the bearish chart patterns. The fresh development applies within the holds and you will forex locations, across numerous timeframes, in addition to every day, per week, and you may monthly maps.

It’s nonetheless advisable that you learn about them, that’s the reason we will determine these to your, albeit within the reduced outline. Way too tend to I find the newest investors trying to change tips which have loose definitions and you may forgotten a number of the secret parts one to the trade means Need to have. It’s crucial you wear’t work with simply run off today and begin trade the fresh habits you merely learned to your a real time account. Within this analogy an inverted pin pub models that may features already been you’lso are result in commit long. Personally I take advantage of wicks to your a lengthier period framework chart to help you see possible portion to locate long otherwise short (opportunity zones). A vintage ABCD trend get an enthusiastic Ab base equivalent to the new Video game base with regards to each other price and go out, while the noticed in the aforementioned analogy.

Once you location it, the brand new triangle development will give you dangerous in order to prize settings for the change bundle. They could arrive red-colored otherwise green to the a chart, however, aren’t precisely thought optimistic or bearish. The value of candlesticks, that have been around for many years, is within the tale they share with.